Table of Contents

Key Takeaways

- Phones lose value faster in 2026. The iPhone 16 depreciation curve is steeper than older models, while Samsung Galaxy S25 is holding value better than S22.

- The resale gap is closing. Samsung’s AI phones are closing the resale gap with iPhone, with mid-2026 projected as a crossover point.

- Timing is everything. Sell 2–6 weeks before major launches to lock peak value and avoid post-announcement dips.

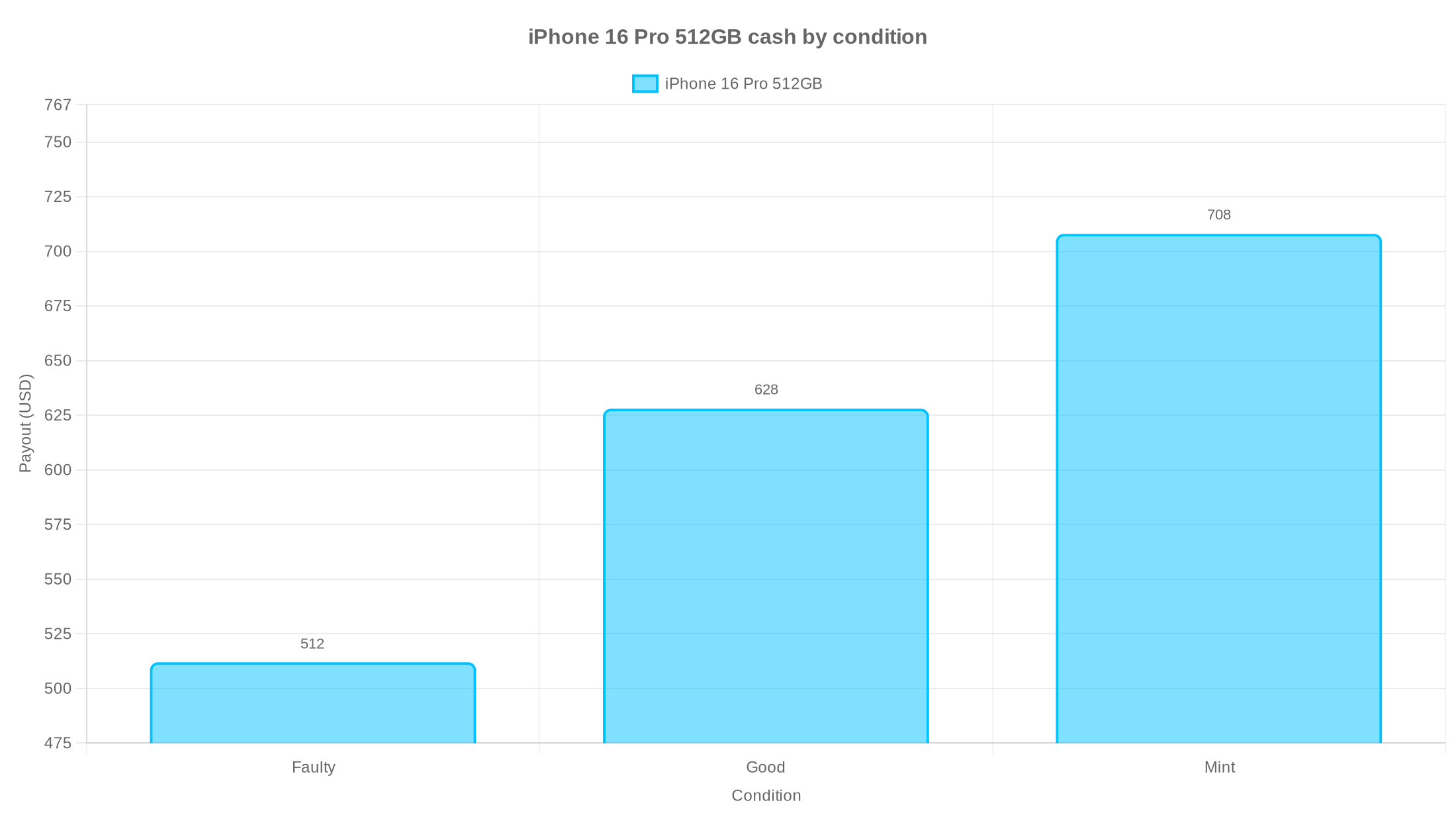

- Condition drives payout. Mint vs faulty can swing offers by dozens of percentage points—battery health and cosmetic care matter.

- Live data beats guesswork. Use a 2026 depreciation tracker to monitor prices daily and set alerts on your exact model.

What a 2026 Depreciation Tracker Actually Measures

A solid 2026 depreciation tracker isn’t just pretty charts. It’s a real-time snapshot of where your phone stands in the market right now—and where it’s headed tomorrow.

First, it tracks real-time price drift by model. The best trackers pull daily offers from top buyback markets and show you today’s range by storage and condition. Second, it applies condition multipliers—small scuffs can cost you big bucks, and broken glass, missing accessories, or poor battery health all cut deep into your final payout.

Then there are sell windows—the golden weeks when demand is hot and prices hold firm. These windows cluster before big launches, promo pushes, and tax refund season. Finally, the tracker reveals cross-brand tides. In 2026, iPhone vs Samsung depreciation is tighter than in past years, meaning timing matters more because price dips now come fast after news hits.

Why this matters now: Launch cycles are tighter, and new AI features show up in waves. That pushes trade-in promos and resale price spikes into shorter windows. If you wait too long, the dip can bite.

The Current Depreciation Landscape (What the Data Says)

iPhone Depreciation Trends

Here’s the part iPhone owners need to see. The iPhone 16 has lost value faster than older models at the same age. At five months post-launch, iPhone 16 models fell 35.4% vs the iPhone 13’s 24.7% at the same point—a jump of 10.7 percentage points. At nine months, iPhone 16 was down 34.7%, while the iPhone 12 at nine months was down 25.2%.

Current resale values by storage and condition show the spread:

- iPhone 16 Pro 512GB: Launched $1,299; now $545–$919 depending on condition (47.6–70.7% depreciation).

- iPhone 16 512GB: Launched $1,099; now $391–$804 (53.4–73.2% depreciation).

- iPhone 15 Pro 256GB: Launched $1,099; now $371–$728 (55.8–77.6% depreciation).

- iPhone 15 256GB: Launched $899; now $305–$594 (57.6–81.0% depreciation).

Samsung Galaxy S Series Improvements

Samsung is trending the other way. Galaxy S25 has depreciated 46.6% at five months post-launch, better than the S22’s 51.9% at the same age. At nine months, S25 is estimated at 47.7% depreciation, keeping the positive slope.

That means Galaxy owners have a bit more runway—and better odds to time the sale right—than a few years back.

The Critical 2026 Crossover Point

Mid-2026 is the turning point. Analysts expect the iPhone–Samsung resale gap to close, with Samsung possibly outpacing Apple on value retention if the lines keep moving like this.

The math behind it: iPhone depreciation is rising about 3.57 percentage points each year. If that keeps up, iPhone could reach about 46.1% average depreciation by 2027. Samsung depreciation is improving by about 1.77 percentage points each year—that could land near 43.1% by 2027.

Bottom line: iPhones still bring bigger dollar amounts today, but the cushion is thinner. If you plan to sell iPhone before new launch this year, timing is your edge.

How Condition Changes What You Get Paid

Condition impact phone payout is no joke. Small differences change offers a lot. A single phone can swing dozens of percentage points by condition rating.

For example, an iPhone 16 512GB shows: Faulty around $512, Good around $628, Mint around $708. That’s a wide gap just on wear and tear. The same model can swing up to roughly 36 points of depreciation based on condition alone.

We also see phone battery health resale value affect offers. Buyers tend to flinch when they see low battery health. Keeping battery health near 88–90% or better feels like a trust mark to many buyers. If you’re below that and plan to sell private, a clean bill from a trusted repair shop can help. For trade-in, check if a battery swap pays back in higher offers before you spend.

Practical Tools to Track Live Prices

You need fresh numbers, not guesses. Live depreciation calculators with daily updates let you search your exact model and storage, see price ranges by condition in one view, compare iPhone vs Samsung depreciation 2026 curves, and watch shifts week by week to pick your sell window.

Use these to set alerts and lock offers when your phone hits your target.

The US Model-by-Model Sell Window Map

This is the map you came for. We take the 2026 depreciation tracker signals and turn them into clear sell windows by brand. Use it to plan your exit in Q1–Q2.

iPhone: Best Time to Sell iPhone 2026

Why sell early this year: The iPhone 16 depreciation curve is steeper than older cycles. Prices can slide faster after rumors heat up.

General window: 2–6 weeks before big fall reveals. In 2026, aim late July through mid-August for most models, earlier if heavy leaks hit. Q1–Q2 twist: If you’re upgrading to a spring Android flagship or want tax-refund cash, late January to early March can be solid. Capture promo spikes before spring announcements eat demand.

Storage note: High storage holds better in absolute dollars, but the percentage dip often looks larger. List storage clearly and include your battery health.

Samsung Galaxy: Samsung Galaxy Sell Window 2026

Why the window feels wider: Galaxy S25 is retaining value better than S22 at the same age, and nine-month depreciation is improving. That gives more breathing room to plan exit timing.

General window: For S25, best sell window is 1–4 weeks before the next big Samsung reveal or Unpacked promos. In early 2026, that means list in late January to mid-February if you’re flipping fast. Galaxy S25 trade-in value: If you see carrier credits spike, compare them to a cash buyback offer. Net value matters more than the sticker credit.

Google Pixel: Pixel Phone Resale Value 2026

Pattern: Pixel prices dip after launch, then settle. Big OS feature drops and Tensor chip news can bump demand short-term. General window: 2–6 weeks ahead of fall Pixel reveals if you plan to switch brands. For A-series owners, watch late spring promos to catch a bounce.

Cross-Brand Timing Note

Mid-2026 is when Samsung resale may match or pass Apple on average depreciation if the trend holds. That shifts demand and affects sell windows across brands. It doesn’t mean “sell now no matter what.” It means watch the live curve and act when your price goal hits.

The 2026 Smartphone Launch Calendar and Why It Moves Prices

Launches shake the market. Announcements trigger price dips as buyers hold out for “the new one.” Use a 2026 smartphone launch calendar to plan around these waves.

Early year: Samsung’s Galaxy S line typically sets the tone. Expect pre-Unpacked promos, early carrier deals, and short-run trade-in boosts. Fall: Apple’s iPhone unveil rules US demand. Prices on older iPhones dip hard after the keynote. Sell iPhone before new launch to lock peak value. Late year: Google Pixel adds pressure in October. A-series joins in late spring or summer.

Tactics to Use the Calendar

Pre-list or pre-lock offers 2–3 weeks ahead of expected reveals. If your target is iPhone, that means mid-to-late August. For Galaxy, late January is prime. Lock a quote when your price hits your goal—many buyback offers hold for days. Ship fast.

Condition, Battery Health, and Other Payout Levers

Little prep makes a big difference. Here’s how to squeeze more from the same phone.

Clean and document. Wipe the screen, remove the case, and take bright, clear photos. Show corners, ports, and the screen. Check battery health. In Settings, show your battery health screenshot. High 80s to 90% reads strong to buyers. If it’s much lower, run the math—a battery swap only makes sense if the resale bump beats the repair cost.

Bundle the box. Add original cable, charger, and box if you have them. Small add-ons build trust and can boost private sale offers. Fix light damage only if it pays. A $100 screen repair won’t help if it only adds $50 to your offer.

“Industry experts warn that activation lock is the number one deal-breaker for resale.”

Unlock and sign out. Turn off Find My iPhone. Remove Google accounts. Clear activation locks. Safety check. Run an IMEI check to show your device is clean and not blacklisted. Deal-breakers for trade-in at GizmoGrind: we can’t accept iCloud-locked, blacklisted, lost/stolen, or water-damaged devices.

How to Use GizmoGrind Tools to Monetize Depreciation

You don’t have to guess. Use live tools and lock value when the window opens.

Watch the curve. Follow live phone price trends 2026 on a depreciation calculator to spot day-to-day drift and set alerts on your model. Compare channels. Cash buyback (like GizmoGrind), carrier credits, or private sale. Private sale can net more but takes more time and risk. Carrier credits can look big but may lock you into a plan. Cash buyback is fast and simple.

Freeze your offer. In hot windows, lock your quote and schedule pickup right away. That helps you dodge post-announcement drops. Keep it green. If your phone is beyond repair, choose certified recycling. We focus on reuse first, then safe recycling to cut e-waste.

Want a deeper breakdown and US phone sell windows map? Bookmark our internal guide: Best time to sell iPhone 2026 and more.

90-Day Phone Upgrade Plan (Q1 2026 Edition)

Weeks 1–2: Get Ready

Audit your phone—note storage, battery health, and any damage. Back up your data—sync photos and messages. You’ll be glad you did. Gather accessories: box, cable, charger, case—pull it all together. Check live prices and set alerts on your model so you know when it pops.

Weeks 3–6: Lock the Window

Watch for promos. Galaxy owners: look for pre-Unpacked bumps. iPhone owners: February can pop as buyers spend refunds. Pre-list or pre-lock 1–3 weeks before expected news—that helps you avoid dips right after announcements. Compare channels: cash buyback vs carrier credit vs private sale. Go with the net dollars plus time saved.

Weeks 7–12: Close the Sale

Lock your top offer and ship right away. Don’t wait a week—prices can slide. Pack it safe: bubble wrap, strong box, tracked label. Remove locks: sign out of iCloud/Google. Factory reset only after backup.

The Broader 2026 Market Backdrop (Why Prices May Feel Tight)

There’s a macro squeeze this year. Global smartphone shipments are expected to fall about 2.1% in 2026 as memory shortages push up costs. That can affect new phone prices and trade-in promos. It can also shape used inventory and resale demand as buyers hold devices longer.

Market watchers echo the same trend—manufacturers are rethinking strategies as 2026 turns choppy.

Real-World Scenarios (Quick Case Snaps)

Scenario 1: iPhone 16 Pro vs Galaxy S25 in Q1 2026

The setup: Both owners want to upgrade by spring. The data tilt: The iPhone 16 depreciation curve is steeper than past iPhones, so waiting into late spring can hurt. Galaxy S25 is holding better than S22 at the same age, giving a bit more runway.

The move: iPhone 16 Pro owner aims to sell in late February, locking a buyback offer during tax-refund demand. Galaxy S25 owner lists 1–2 weeks ahead of Samsung’s next event to catch promo spillover, then locks a cash quote when it peaks. Result: Both beat the post-announcement dip. The iPhone nets more dollars, but the S25 closes the gap vs last cycle.

Scenario 2: Pixel Owner Timing Around Spring vs Fall

The setup: Pixel owner wants to switch to Galaxy mid-year. The pattern: Pixel demand softens after fall launches, then stabilizes. Spring feature drops or promos can bring a small bump.

The move: Watch live prices in March/April. If a spring promo lifts Pixel phone resale value 2026, pre-lock a quote and ship fast. If not, plan a 2–6 week exit ahead of fall reveals when buyers start shopping last-gen Pixels.

Channel Check: Which Path Pays in 2026?

Cash buyback (like GizmoGrind): Fast, simple, safe. Good for busy sellers who want money now and no risk. Carrier trade-in credit: Big headline numbers but locked to plans. Great if you were upgrading there anyway. Private sale: Highest potential payout when your phone is mint and in demand. But more time, more steps, and more safety risks.

Pro tip: time is money. If waiting three more weeks risks a 5–10% dip, a fast cash quote may beat chasing a few extra dollars in a private sale.

Frequently Asked Questions

What is the best time to sell iPhone 2026?

Aim 2–6 weeks before Apple’s fall launch cycle. In Q1–Q2, late February can also pop due to refunds and upgrade promos. The iPhone 16 depreciation curve is steeper than before, so don’t wait too long.

When should I sell a Samsung Galaxy in 2026?

For Galaxy S25, list 1–4 weeks before the next Samsung event or promo wave. Value retention is improving vs older S models, so you have a bit more room to plan.

Do storage tiers change depreciation?

Higher storage brings higher offers in dollars. In percentage terms, the drop can look larger. Always list your exact storage—buyers pay for clarity.

How much does condition matter?

A lot. For an iPhone 16 512GB, mint vs faulty can swing the value by dozens of percentage points.

Should I repair before selling?

Only if the repair cost is less than the expected bump in resale. Small fixes like a simple battery swap can help private sale, but run the math first.

Any safety tips for private sales?

Meet in public, use secure payments, confirm the buyer’s info, and never hand over a phone with your accounts still on it.

What devices can’t GizmoGrind accept?

We can’t take iCloud-locked, blacklisted, lost/stolen, or water-damaged devices.

How do macro trends affect resale in 2026?

Global shipments may dip about 2.1% this year due to memory costs. That can tighten promos and shift demand. Plan windows around announcements and watch live prices.

Your 2026 Action Plan: Lock Value, Reduce Waste, Upgrade Smarter

This year, depreciation is moving faster and smarter. The iPhone vs Samsung depreciation 2026 race is closer than ever. That’s your signal to use data, not hunches. Watch the live curve, plan your sell window, prep your device, and lock your best offer before the dip.

- Check live depreciation now and set your alert.

- Lock your top offer in 60 seconds when it hits.

- Download our 2026 sell windows calendar and pin your dates.

Ready to move? Start with our US phone sell windows map and step-by-step plan: Best time to sell iPhone 2026 and more.