Table of Contents

Key Takeaways

- Sell before Apple’s September keynote—that prelaunch window historically delivers peak cash offers and avoids the 15–25% post-launch slide backed by data from GizmoGrind and BankMyCell.

- Unlocked, pristine, higher-storage iPhones consistently command premiums, with unlocked status alone often adding $50–$100 per Instawireless and GizmoGrind.

- Lock a quote 7–30 days ahead to protect against the post-keynote drop—many buyback platforms honor pre-event pricing if you ship on time.

- Cash > credit for flexibility and true value; late-year carrier promos skew to long, credit-heavy contracts per GizmoGrind and Instawireless.

- Missed September? Move quickly in October–November, present your device perfectly, and favor cash marketplaces; prices keep softening after launch, per Vertu and BankMyCell.

Why September Is the Money Month in 2025

Think of the iPhone resale market like concert tickets: prices peak when everyone wants in and supply is tight. For iPhones, that moment is the weeks before Apple’s September event—demand surges, but new inventory hasn’t landed yet.

Once the keynote wraps and the new model ships, older iPhones slide fast—15–25% depreciation within weeks is common, according to trade-in trackers like GizmoGrind and BankMyCell. Analyses from Vertu and guides at Instawireless echo the same seasonality.

Bottom line: Sell before the keynote, not after—the market rewards early movers, then punishes hesitation.

Peak resale tends to cluster 3–6 months after a model’s release—right when late-summer buyers hunt for “almost new” devices. Translation: September through early November is prime time, with the best outcomes before Apple’s show.

The September Prelaunch Window: Your Golden Opportunity

Demand Peaks, Supply Stays Tight

In August and early September, buyers want near-flagship performance without launch-day prices. Meanwhile, most owners haven’t listed yet—they’re waiting for the keynote. Fewer listings plus more buyers = stronger cash offers.

Unlocked, Pristine, Higher-Storage Models Win Big

Unlocked status expands your buyer pool and usually adds $50–$100 to offers, per GizmoGrind and Instawireless. Storage matters too—256GB, 512GB, and 1TB devices often land $100–$200 premiums. And condition/completeness count: clean phones with original accessories tend to earn more.

Lock In Your Quote Before the Event

Many platforms let you lock a quote for 7–30 days. Capture your price in late August or early September and ship within the window—even if the keynote passes—so you’re shielded from the immediate post-event drop. Photograph condition, read the fine print, and hit that ship-by date.

Your 60-Day Prep Calendar (August–September, with a Right-Now Tweak for October)

60 days out—assess and optimize. Back up everything, clean your device, and be honest about wear. Verify unlock status early—carriers may take days to process, and the unlocked premium adds real dollars per BankMyCell.

30 days out—gather and document. Find the box and cable if you have them. Take clear, well-lit photos (front, back, edges, any blemishes). Cross-check prices on GizmoGrind, BankMyCell, and Swappa to anchor expectations.

7–14 days out—lock and ship. Choose a top cash quote (not bill credits), confirm shipping timelines, disable Find My, sign out of iCloud, remove SIM/eSIM, factory reset, and record your IMEI/serial. Lock the price in early September if you can.

Missed September? If it’s October, compress the steps into a single week. Post-launch carrier promos tend to be credit-heavy and contract-bound, per GizmoGrind. If you want liquidity, prioritize direct cash buybacks and ship quickly.

Cash vs. Credit: Make the Right Choice for Your Wallet

Carriers advertise eye-popping trade-in “values,” but many are bill credits spread over 24–36 months with plan requirements. When you compare iPhone cash vs credit trade-in, clarity beats hype.

Cash Offers: Flexibility and True Value

Cash from trusted buyback platforms gives immediate, unrestricted funds. In the prelaunch window, cash quotes often rival or beat headline carrier numbers once you factor in lock-ins, per GizmoGrind and BankMyCell.

Credit Offers: Convenience with Conditions

Credits can lower monthly bills if you’re staying put and upgrading anyway—but they usually require pricey plans and long commitments, and they can vanish if you leave early, per Instawireless.

Decision Rule: Follow Your Priorities

- Choose cash if you want flexibility, no strings, and immediate payout—especially in September.

- Choose credits if you’ll keep your carrier, like the plan, and the total contract math truly beats cash.

Pro tip: The “highest” trade-in isn’t always the best deal—calculate the full cost of staying locked for 2–3 years.

Quick Optimization Levers to Boost Your Price Today

Unlock Your Device

Unlocked iPhones regularly earn a $50–$100 lift, supported by GizmoGrind, Instawireless, and BankMyCell. If your device is paid off, request an unlock before listing.

Choose Higher Storage Tiers

256GB, 512GB, and 1TB phones can command $100–$200 premiums. Highlight capacity in your listing and price checks.

Present Pristine Condition

Deep-clean, replace a scratched screen protector, and photograph honestly in bright, natural light. Verified condition and completeness correlate with higher payouts, per Instawireless.

Include Original Accessories

The box, cable, and SIM tool build trust and can nudge offers higher. If you’ve got them, show them.

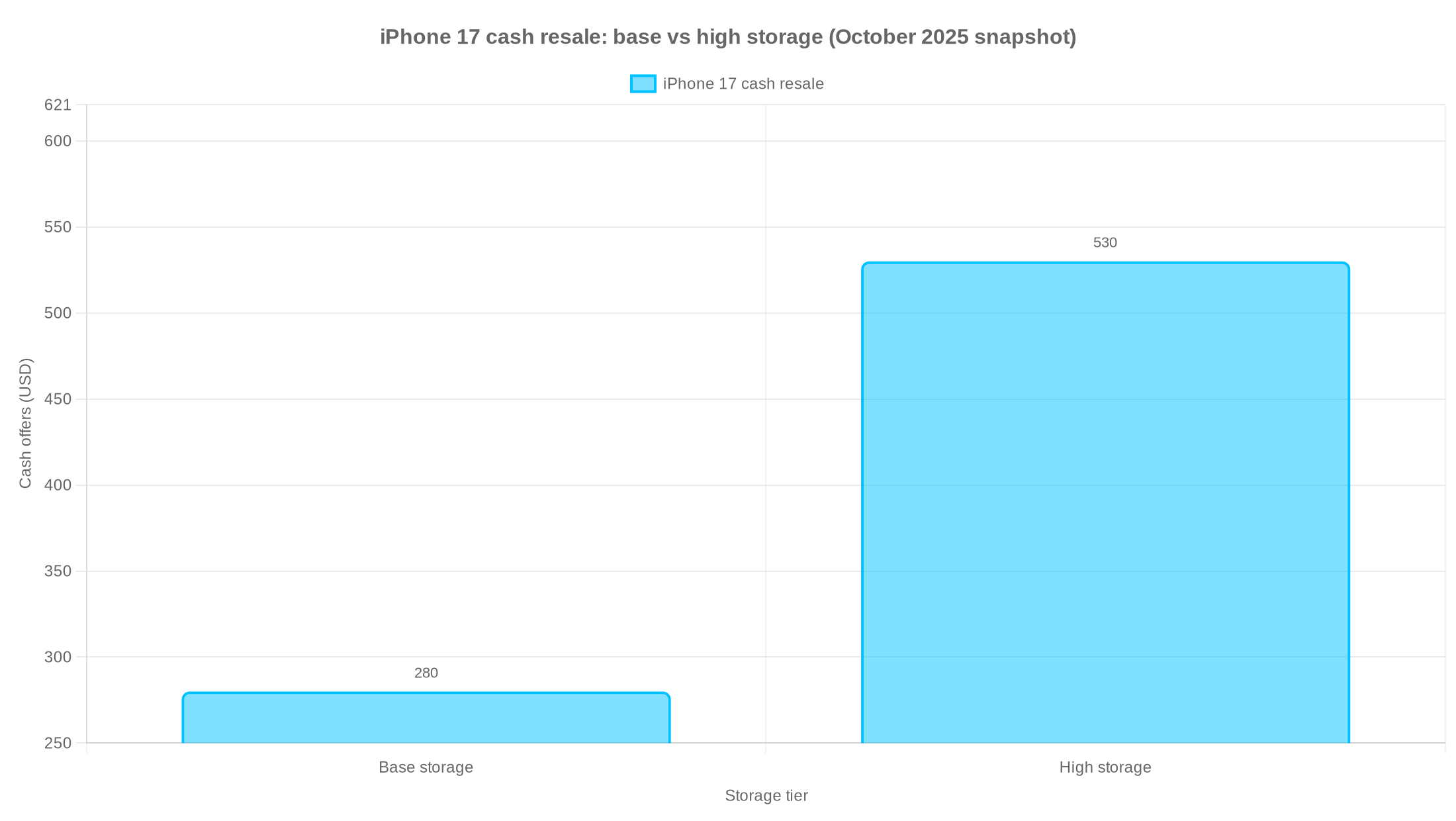

October 2025 Snapshot: What “Missed-September” Sellers Can Expect

Expect Some Post-Launch Drop

After the iPhone 17 launch, values typically decline 15–25% within weeks, per GizmoGrind and BankMyCell. Still, current-year and recent flagships retain solid value—especially unlocked and in top condition—though another dip after launch is normal, as seen in Vertu’s and BankMyCell’s retention data.

Your October–November Game Plan

- Unlock now and relist—premiums shrink but persist.

- Present perfectly: clean, document, and disclose.

- Favor immediate cash over credit-heavy promos.

- Act before Black Friday, when promo waves crowd listings.

Real-World Price Anchors

Based on October 2025 market reads from GizmoGrind, BankMyCell, and Swappa:

iPhone 17 (base): ~$280–$350 cash; high storage can reach ~$530+. iPhone 15 Pro Max: ~<$600 average, with 512GB/1TB unlocked pushing higher. iPhone 15 Plus: around mid-$400s, higher for big storage. iPhone 14: low-to-mid $400s, with storage bumps above ~$500.

Tools and Resources to Act Now

Get an Instant Cash Quote

GizmoGrind focuses on fast, transparent cash offers for clean devices—no water damage, no iCloud locks. Lock a quote and ship on time to preserve pre-event pricing.

Price-Check and Compare

Apple Trade In offers convenience and credits toward new devices—use it as a baseline. Swappa shows real-time market prices and recent sales to anchor your listing. BankMyCell aggregates buyback quotes and helps you track iPhone trade-in market trends 2025.

Read the Fine Print on Carrier Promos

Big numbers often hide long commitments and higher plan tiers. Reports from GizmoGrind and Instawireless show late-Q4 promos skew heavily to bill credits. If you want true value, run the full-contract math.

One-Page Quick-Launch Checklist

- Back up your data via iCloud or computer.

- Verify unlock status with your carrier.

- Clean and document condition with clear photos.

- Gather original accessories if available.

- Price-check on GizmoGrind, BankMyCell, and Swappa.

- Lock your best cash quote (avoid long bill-credit tie-ins).

- Prep the device: disable Find My, sign out, remove SIM/eSIM, factory reset.

- Ship on time to preserve the locked price.

Bottom Line for 2025

The best month to sell for maximum cash is September—before Apple’s keynote. That’s when demand peaks, supply stays tight, and quotes are strongest. Missed it? Move fast in October–November, favor cash over credit-heavy promos, and lean on unlock status, storage, condition, and completeness to hold value.

Timing the sale iPhone 2025 isn’t magic—it’s strategy. Use the calendar, prep well, compare offers, and strike when the market is hot. Data in this guide draws on Vertu, GizmoGrind, Instawireless, BankMyCell, and Swappa.

Frequently Asked Questions

When is the absolute best time to sell my iPhone in 2025?

Early September, just before Apple’s keynote. Multiple trackers, including GizmoGrind and BankMyCell, show values dip 15–25% after the launch.

If I missed September, should I wait until Black Friday?

Usually no. Post-launch supply surges and credit-heavy carrier promos crowd the market. You’ll often do better locking a cash quote and shipping before the holiday promo wave.

Is cash really better than carrier bill credits?

For flexibility and true value—yes. Credits tie you to a plan for 24–36 months, while cash is immediate and unrestricted. As Instawireless notes, the flashiest credits often carry strict conditions.

How much more is an unlocked iPhone worth?

Typically $50–$100 more than a carrier-locked equivalent, depending on model and timing, per GizmoGrind and BankMyCell. If your phone is paid off, request an unlock before listing.

Do accessories and the original box increase my offer?

Often, yes. Completeness signals care and can bump confidence and bids—especially on peer-to-peer sites like Swappa.

What’s the one thing that boosts price the fastest?

Unlocking, followed closely by excellent presentation: a spotless device with clear, honest photos. These two steps consistently lift offers across marketplaces.