“`html

Table of Contents

Key Takeaways

- iPhone still holds the resale crown—Pro models often retain over 70% value after one year, but expect 15–30% dips right after September launches.

- Galaxy and Pixel are closing the gap—7-year update promises lift trade-in values, especially in the first 90 days post-launch.

- Cross-border math matters—Canadian quotes in CAD can beat U.S. cash after currency conversion, but only if you factor in FX, shipping, and regrade risk.

- Carrier credits vs cash—Bill credits look big but pay over 24 months; cash is instant freedom. Run the full-term math before deciding.

- The 60-day playbook—Stack quotes at day 60, prep your device at day 30, lock your best offer at day 14, and ship at day 7 to capture peak value.

2026 Cross-Border Trade-In Snapshot

If you’re weighing iPhone vs Galaxy vs Pixel trade-in 2026 cross-border, you’re in the right place. This is the guide for U.S. sellers who want the best payout by timing offers, watching currency moves, and picking the right market—U.S. or Canada.

Think of it like a road trip. You want the fastest route, the best gas prices, and no surprises at the border. We’ll show you where values are strong, how to do the currency math, how carrier trade-in promos US vs Canada 2026 change the game, and the exact 60-day play to lock in top quotes.

Quick promise: every claim here is based on current depreciation data, market cycles, and carrier offers. We link sources once so you can spot-check fast.

The vibe right now: it’s a seller’s puzzle

Apple’s fall launches shake values. Samsung’s spring drops move carriers. Google’s fall events lift Pixel demand. With the U.S. dollar staying strong at times, Canadian quotes can turn into sweet U.S. net after currency exchange.

iPhone holds the resale crown. iPhones keep the highest trade-in values. Recent Pro models often hold over 70% after one year, thanks to Apple’s tight ecosystem, premium build, and long software support. But watch out: older iPhones can dip 15–30% right after September launches. Source: Trade-In Trends: What Phones Are Worth the Most?; Which Cellphones Hold Their Resale the Longest in 2025?

Galaxy and Pixel are closer than before. Android flagships used to drop faster. Now, 7-year update promises on top models help Galaxy and Pixel keep value longer, especially in the first 90 days after launch. Source: Trade-In Trends: What Phones Are Worth the Most?; Which Cellphones Hold Their Resale the Longest in 2025?; The 2025 Smartphone Depreciation Calculator

Demand still favors iPhone in the U.S. In 2025, Apple led with about 20% global share, helped by iPhone 16/17 momentum; Samsung was close at 19%, while Pixel grew fast (up 25%) but stayed far behind. Strong U.S. iPhone demand keeps trade-in floors high. Source: Android Central: Google’s Pixel had a good 2025, but it still trails the big phone makers

Carriers tell the story. Example: one October 2025 round-up showed up to $1,100 off an iPhone 17 Pro Max with any-condition trade-in, while some Pixels were “free” with new lines—clear proof that iPhone pulls the biggest promo dollars. Source: Best cell phone deals in October 2025

Key takeaway: Expect iPhone to set the cross-border floor. Galaxy S-series is strong right after launch (watch Galaxy S26 trade-in offers 2026). Pixel can pop around Google’s fall cycle—especially for clean, unlocked units.

US–Canada Cross-Border Economics in 2026

Here’s how cross-border trade-in works for U.S. sellers eyeing Canada. A little math and a little timing can mean real cash.

Currency math made simple

A Canadian quote in CAD may beat a U.S. cash quote once you convert to USD, subtract shipping, and account for any fees. If the U.S. dollar is strong, your USD net can jump.

Move fast on “good” FX days. Many buyback sites let you lock a quote for 7–14 days. Use that to hedge FX: lock and ship before rates move against you.

Taxes, duties, and logistics

Check for duties on used electronics crossing into Canada. Keep your proof of ownership and a clear invoice for customs review. Use insured shipping with tracking.

Ask about return handling. If a buyer regrades your phone, how do they return it? Who pays? This matters a lot across borders.

Carrier promos vs cash

Canadian carriers sometimes run big bill credits on flagships. If you plan to keep service for 24 months, credits can beat cash. If you want true cash now, a buyback may win. Compare both paths.

Cross-border checklist (print this)

- Offer type: cash vs bill credits

- FX rate at lock time (note the exact rate)

- Shipping cost + insurance

- Duty risk and customs paperwork

- Return policy and regrade rules

- Device condition disclosures (photos, battery health, IMEI clean)

For a deeper walkthrough: Cross-Border Selling Guide (Canada) and Canada Trade-In Channels (2025)

Brand-by-Brand Value Outlook for 2026

iPhone: still king of resale

The story stays the same: iPhone leads value retention. New Pro models can hold a strong share of their price one year in. But older iPhones take a sharp hit around September iPhone events. Source: Trade-In Trends: What Phones Are Worth the Most?; Which Cellphones Hold Their Resale the Longest in 2025?

Best window to trade: a few weeks before September. Also watch for spring promo flurries when carriers push switch deals.

Galaxy: closing the gap after launch

With 7-year updates and strong S-series demand, Galaxy trade-in value holds better in the first 90 days post-launch. Mid-cycle, values drift faster than iPhone, but promos often fill the gap. Source (depreciation context): The 2025 Smartphone Depreciation Calculator

Best window to trade: a few weeks before the next S-series or Fold/Flip reveal; values can dip right after new models hit.

Pixel: niche, but rising

Pixels trail iPhone on resale but can punch above many Androids. Camera fans and long support windows help value right before Google’s fall event. Source: Trade-In Trends: What Phones Are Worth the Most?

Best window to trade: late summer to early fall, before Pixel launch hype and rumors soften older models.

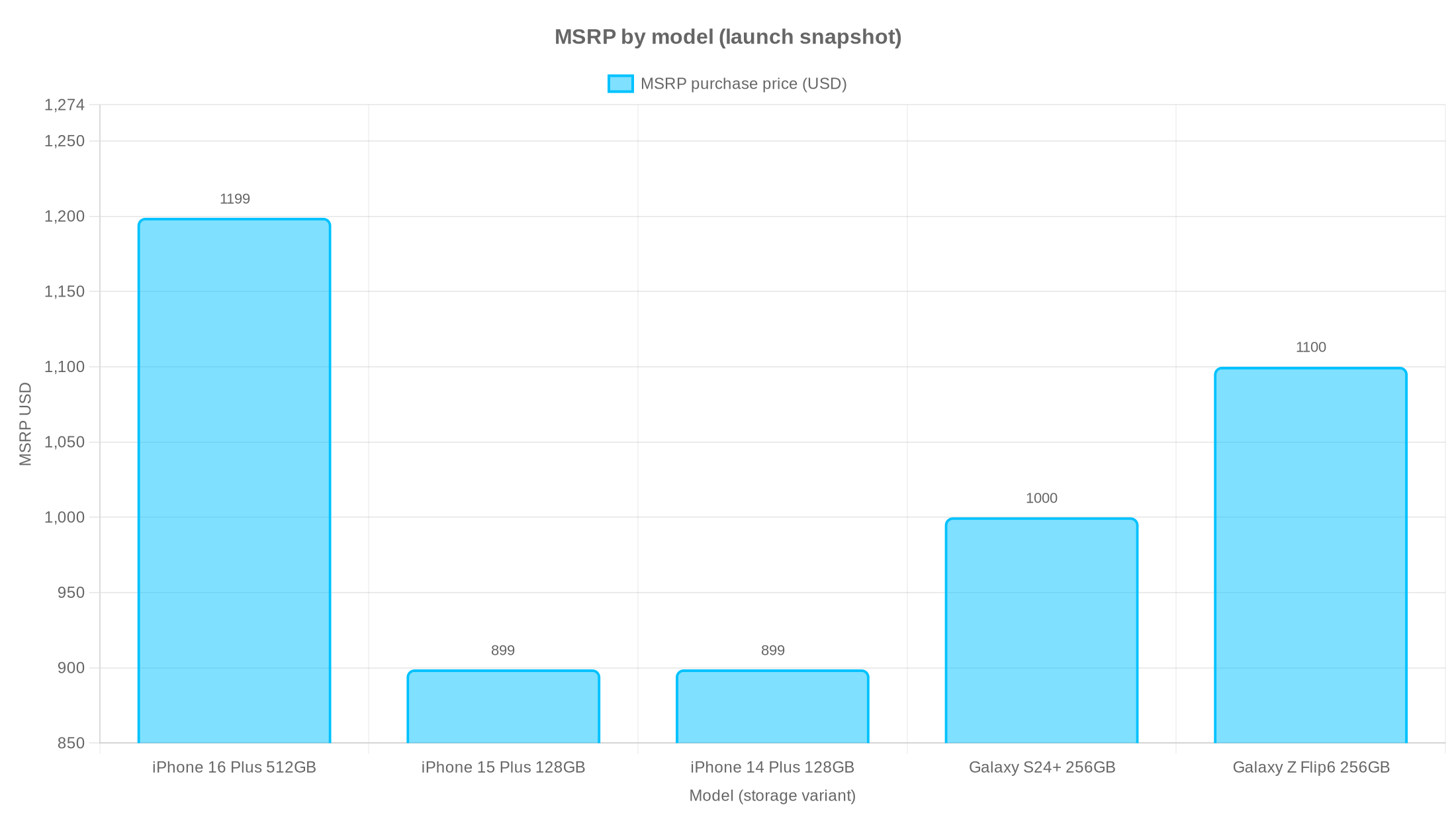

Key 2025–early 2026 depreciation data (your quick benchmark)

From recent calculators and reports (use as a guide; exact numbers vary by condition and storage). Source: The 2025 Smartphone Depreciation Calculator

- iPhone 16 Plus 512GB (2024): original ~$1,199; 1-year trade-in ~$614; retained value ~48.8%.

- iPhone 15 Plus 128GB (2023): original ~$899; 1-year trade-in ~$391; retained value ~56.5%.

- iPhone 14 Plus 128GB (2022): original ~$899; 2-year trade-in ~$268; retained value ~70.2% at the 2-year mark.

- Galaxy S24+ 256GB (2024): original ~$999.99; 1-year trade-in ~$316; retained value ~68.4%.

- Galaxy Z Flip6 256GB (2024): original ~$1,099.99; 1-year trade-in ~$307; retained value ~72.1%.

Pixel trend: typically below iPhone/Galaxy overall, but newer models fare better before Google’s fall cycle, thanks to camera and software appeal. Source: Trade-In Trends: What Phones Are Worth the Most?

2026 market timing rules you can bank on

Trade iPhones before September, Galaxies before January/March, Pixels before October to avoid 15–30% dips immediately after launches. Source: Trade-In Trends: What Phones Are Worth the Most?

Software updates matter. Apple’s long support keeps values high; Samsung and Google now promise 7-year updates on flagships, lifting mid-cycle resale vs budget Androids. Source: Which Cellphones Hold Their Resale the Longest in 2025?; Trade-In Trends: What Phones Are Worth the Most?

The 60-Day Cross-Border Playbook to Lock Top Quotes

This is your 2026 phone launch trade-in playbook. It’s simple by design. Pick a target trade-in date. Then follow the countdown.

1) Day 60: Scout and stack

Grab quotes from U.S. buyback sites, U.S. carriers, and at least two Canadian channels. Save screenshots with timestamps.

Note offer type (cash vs bill credits), model, storage, and IMEI status. Flag any “any condition” promos.

Start an FX watch: note USDCAD today. Add a “target FX” line you’ll pull the trigger on.

Helpful tool: 60-day trade-in countdown 2026

2) Day 30: Prep and proof

Run diagnostics. Check battery health. Photograph the device in bright light. Capture serial/IMEI and screen condition.

Back up data. Clean and reset. Remove activation locks. Carrier-unlock if you can.

Track model rumor dates. If a launch is close, move your trade-in date forward by one to two weeks.

3) Day 14: Lock window opens

Re-quote all channels (prices change). Update your FX watch.

If a carrier credit jumps, compare 24-month math vs cash now. If cross-border cash leads after FX and shipping, circle it.

Pick a “lock trigger”: Example—”Lock if USDCAD is 1.35+ and Canadian cash > U.S. cash by $40.”

4) Day 7: Lock and ship

Once your trigger hits, lock the quote. Print labels. Pack with photos inside the box. Ship insured with tracking.

Keep copies of the device wipe steps and IMEI unlock proof. This cuts regrade risk.

5) Day 3 to payout: Track and verify

Watch tracking daily. Save delivery proof.

If the buyer regrades, use your photos and wipe proof to dispute fast.

Tools: The 2026 depreciation tracker and sell windows cheat sheet helps you time the dips and spikes.

Carrier Credits vs Cash: US vs Canada Mechanics in 2026

Carrier bill credits can look huge. But credits pay out over 24–36 months, often with “line must stay active” rules. Cash is simple: ship, get paid, move on. Which wins? It depends on your plan.

When credits beat cash: You already want a new line or plan. You’ll keep it the full term. The promo applies to the exact model you want. This often happens at iPhone launch time and right after Galaxy S-series drops. Example deal patterns: up to $1,100 off iPhone 17 Pro Max with any-condition trade-in; some Pixels free with new lines. Source: Best cell phone deals in October 2025

When cash beats credits: You want freedom. You don’t want to be tied down for 24 months. Or the credits require a pricier plan that eats the value over time.

Red flags to watch:

- “Any condition” fine print that excludes your exact model

- Downgrade regrades for tiny scuffs

- Credits that vanish if you change or cancel lines early

- Restocking or return fees on cross-border returns

Privacy, Activation Locks, and Compliance Across Borders

Clean phones earn more. It’s that simple. A proper wipe and unlock cuts regrades and boosts net.

Do this before you ship: back up, sign out of iCloud/Google/Samsung, turn off Find My, factory reset, and remove carrier locks. Save proof-of-erasure.

Keep an “ownership and wipe” packet with your IMEI, serial, and wipe steps.

This can cut disputes and lift value by 20–30% in practice because buyers move your device faster.

For a simple checklist and affidavit format you can reuse: Privacy Before Selling Phone (2026)

Note: At GizmoGrind, we accept most used smartphones, tablets, MacBooks, Apple accessories, and smartwatches. We do not accept iCloud-locked, blacklisted, lost/stolen, or water-damaged devices. Our process is fully online with fast quotes and payouts. We aim to help you get top value and keep devices in use, not waste.

Practical Roadmap: Step-by-Step Execution

Here’s the quick walk-through. Use this when you’re ready to move.

1) Gather quotes

U.S. carriers, U.S. online buyback sites, and at least two Canadian channels (cash and credits). Aim for three to five quotes.

2) Normalize all in USD

Convert Canadian quotes with today’s USDCAD. Subtract shipping and insurance. Note any duty risk. Compare apples-to-apples.

3) Prep your device

Battery health screen. Diagnostics. Unlock status. Clean photos. Factory reset. Proof-of-erasure. This reduces regrades.

4) Lock and ship

When your FX and price trigger hits, lock the best offer. Ship insured. Save proof.

5) Reinvest

If you’re upgrading, plan your next move. Use credits only if the total 24-month math beats cash.

Need a cross-border channel overview? Start here:

Scenarios and Quick Wins (Fast Math)

These are sample playbooks to practice the math. Numbers are examples to show the flow. Your quotes will vary.

iPhone 16 Pro (Unlocked, 256 GB)

- U.S. cash quote: $620

- Canadian cash quote: 900 CAD

- FX today: 1.35 (CAD to USD). 900 CAD ÷ 1.35 ≈ $667

- Shipping/insurance to Canada: $28

- Likely grading variance: 5% ($33)

U.S. net: $620

Canada net: $667 − $28 − $33 ≈ $606

Verdict: Today, the U.S. cash wins by ~$14. But if FX improves to 1.40, Canada net jumps to about $612. If you see 1.40+, lock and ship. Timing matters.

Galaxy S26 (Base) in first 30 days post-launch

- U.S. cash quote: $520

- Canadian carrier credits: 1,200 CAD over 24 months (~50 CAD/month)

- FX: 1.33

If you plan to keep the line 24 months and the plan price is the same, those credits net about $902 USD. But if the plan costs $15/month more than your current plan, that eats $360 over two years, making the real value about $542 USD.

Verdict: Credits look big, but after plan math, Canada only beats U.S. cash by ~$22. If you won’t keep the plan full term, take cash.

Pixel 10 Pro (Unlocked)

- U.S. cash plateau mid-year: $430

- Canadian boutique buyer cash: 650 CAD (they want clean, unlocked Pixels)

- FX: 1.36

- Canada USD after FX: ≈ $478; shipping/insurance $25; regrade risk 10% ($48)

Canada net: ~$405

Verdict: U.S. cash wins if regrade risk is high. But if your device is mint and you can document condition well (lowering regrade to 3%), the Canada net improves to ~$449, and Canada wins by ~$19. Condition proof matters a lot for Pixel.

A quick reality check from the crowd

Sometimes the market just feels off. When a user sees a low offer, it can spark second thoughts. Here’s a real-time pulse that shows why timing and channel choice matter:

“i have iphone 15 need the 17 , trade in value is only $300 , …” — david_j5000 (X)

i have iphone 15 need the 17 , trade in value is only $300 , that leaves a balance of $500, i would think there would be some discretionary discount for 20+ year loyal customer

— david j (@david_j5000) January 21, 2026

Use this as a reminder: check three quotes, watch FX, and never take the first number at face value.

Where Cross-Border Shines (and Where It Doesn’t)

Shines when:

- The U.S. dollar is strong vs CAD (USDCAD trending up)

- Your device is a high-storage flagship (iPhone Pro/Pro Max, Galaxy S Ultra) with clean history

- Canadian carriers run rich credits that fit your 24-month plan anyway

- You can ship fast and insure for peace of mind

Doesn’t shine when:

- Your device has non-disclosed issues (cracks, low battery health, lock)

- Shipping and regrade risk erase FX gains

- FX dips after you lock, or you miss the promo window

- Bill credits require plan changes that cost more over time

How Launch Cycles Shape Your Plan

iPhone: trade before September. After Apple’s reveal, older iPhones can fall fast (15–30%). Source: Trade-In Trends: What Phones Are Worth the Most?

Galaxy: trade before January/March. S-series and foldables trigger value resets, but early promos can pay big.

Pixel: trade before October. Google’s fall event pulls eyes (and dollars) to the new models.

Pro tip: Stick to flagship trims with higher storage and premium materials. Those hold value best across borders. Source: Trade-In Trends: What Phones Are Worth the Most?

Cross-Border Phone Trade-In US Canada 2026: The Quick Math Template

Use this tiny template to compare any two offers in under five minutes:

Cash-vs-cash:

- Offer A (U.S. cash): $____

- Offer B (Canada cash): ____ CAD ÷ FX rate = $____

- Subtract ship + insurance: $____

- Subtract likely regrade (5–10%): $____

- Add/remove duty if noted: $____

- Winner: __________ by $____

If Offer B is bill credits:

- Total credits over term (CAD) ÷ FX = $____

- Plan cost difference over term: −$____

- Early cancel risk? If yes, value may drop to $____

- Winner: __________ by $____

Frequently Asked Questions

Q: Is cross-border trade-in legal for used phones?

Yes, but follow customs rules. Keep proof of ownership and a clean IMEI. Check returns handling in case of regrade.

Q: Do I pay duties shipping to Canada?

It depends on carrier and classification. Ask the buyer and your shipper. Keep invoices clean and accurate.

Q: How do I control currency risk?

Lock a quote and ship fast. Many sites hold quotes 7–14 days. Use that to “hedge” your FX.

Q: Will I get regraded?

It’s common. Cut risk by sending clear photos, battery health, IMEI/serial, and wipe/unlock proof.

Q: Cash or carrier credits?

If you plan to keep service for 24 months and the plan cost won’t rise, credits can beat cash. If you want freedom, cash is simpler.

Q: When is the best time to trade in my iPhone in 2026?

Late summer, before Apple’s September event. Values often dip 15–30% right after. Source: Trade-In Trends: What Phones Are Worth the Most?

Q: Which brand wins in 2026: iPhone vs Galaxy vs Pixel trade-in value?

iPhone still leads. Galaxy S-series is close right after launch. Pixel improves near Google’s fall cycle. Source: Which Cellphones Hold Their Resale the Longest in 2025?; The 2025 Smartphone Depreciation Calculator

Final Word: Your 2026 Cross-Border Winning Move

- Start 60 days out. Stack quotes, watch USDCAD, and line up your “lock trigger.”

- Trade iPhones before September, Galaxies before the spring drops, and Pixels before October.

- Compare cash vs credits with the full 24-month math. Normalize Canadian quotes in USD after FX, shipping, and regrade risk.

- Keep your device spotless and your paperwork cleaner. That’s how you beat regrades and win cross-border.

“Clean, unlocked, and well-timed” is the motto. Do that, and your iPhone vs Galaxy vs Pixel trade-in 2026 cross-border decision gets easy—and your payout gets better.

More help from GizmoGrind:

- Cross-Border Selling Guide (Canada)

- Canada Trade-In Channels (2025)

- 60-Day Trade-In Countdown (2026)

- 2026 Depreciation Tracker + Sell Windows

- Privacy Before Selling Phone (Affidavit + Checklist)

Sources cited once for quick validation:

- Trade-In Trends: What Phones Are Worth the Most?

- Which Cellphones Hold Their Resale the Longest in 2025?

- The 2025 Smartphone Depreciation Calculator

- Android Central (Pixel market share context)

- Tom’s Guide (carrier promo examples)

One last reminder before you ship:

“Activation lock is the number one deal-breaker for resale.”

Back up. Sign out. Turn off Find My. Factory reset. Unlock the phone. Then box it with proof. Your future sale will thank you.

“`